Should I Buy a House as a Single Person?

Posted on May 16, 2022

Is it hard for a single person to buy a house? This question is often at the forefront of people’s...

Posted on May 16, 2022

According to Pew Research Center, more households are renting than at any point in the last 50 years. Many people, however, dream of getting out of the rental cycle and into their own homes. For some, it’s an opportunity to build equity; for others, it's about gaining control and stability - not having to worry about getting kicked out when a lease ends, or dealing with an unexpected $200 increase in monthly bills when the landlord raises the rent.

If you’re wondering how to save for a house while renting, you’re not alone. There are several steps you can take in order to make this dream a reality - though it can definitely be an adjustment if you’re used to just paying rent. Here’s what you need to know.

Meeting with a Realtor and mortgage advisor is a good first step - they’ll be able to evaluate your financial situation and give you a realistic understanding of your future budget.

"The first step you should take is to seek out the advice of a real estate professional. A lot of first-time homebuyers look at Zillow and Redfin as their first step, and that can only take you so far," explains North Virginia-based Realtor Brian Bauer. "And you're only able to visit open houses, or potentially hit that button and get paired with a real estate agent anyway, and maybe it’s not someone you’re comfortable with, and you haven’t vetted them."

Remember, it’s the seller who pays both Realtors’ fees (at closing), not you - so you don’t need to worry about running up the bill here by seeking advice.

"A lot of renters will do the work on their own because they believe that engaging a real estate professional is going to cost them something, and it’s a terrible misunderstanding. The seller pays all the agent fees - so using our services is free," says Bauer.

It can be incredibly tempting to click through Zillow listings, check the monthly payment estimate, and fall in love with the homes you find that are in your "budget." These listings, though, don’t tell the full story - and you might not be working with the budget you think you are. Most home listing sites that estimate monthly payments, for example, are assuming the buyer will put down 20% - even though the median for first-time homebuyers is actually 7%.

This amount is also not the same as a rental payment, because it doesn’t include the 1% of your home’s value you should be setting aside each year to deal with routine maintenance (like a washing machine replacement, roof repairs, etc). Once you own your home, you can no longer rely on a landlord to handle and pay for these fixes. As an example: if you buy a $400,000 home, that’s $4,000 - or about $330 per month you should be setting aside, ideally.

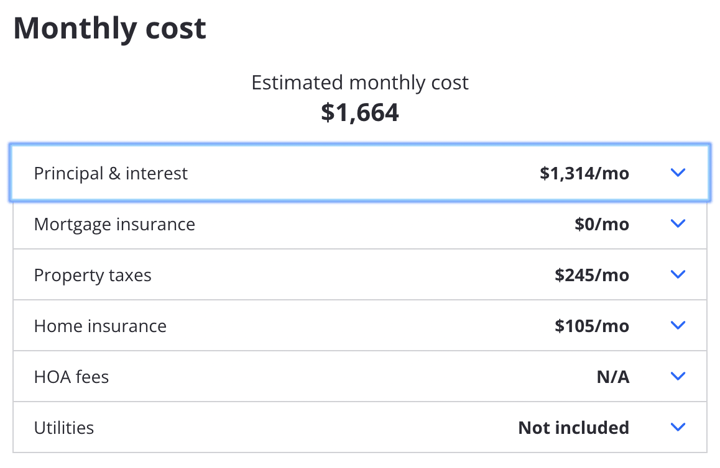

"Zillow's monthly payments aren't taking into account all sorts of factors. It's generally not figuring out property taxes, escrow, PMI if that's the case, association dues, HOA dues, or condo fees - it's figuring out payments for someone with an 850 credit score applying for a 30 year fixed mortgage, receiving the best interest rate possible and dividing that up over 30 years and 12 months. They want a rosy outlook so that you look at their listings and think, 'Hey, I can afford that.'”

And even if you think you can afford a certain home based on your current spending, a lender might not sign off on it. Lenders will not allow borrowers to have a debt-to-income ratio of 50-50, for example.

Meeting with a mortgage advisor (similar to a Realtor, you don't be expected to pay them hourly for their services - they receive a fee from the lender if you opt for a mortgage with them) can help you solidify what you can actually afford.

No matter what, you’re likely going to need a minimum of 3% of the home’s value as a down payment; you’ll also need anywhere from 3-7% of the home’s value for closing costs. Closing costs cover everything from mortgage fees to the home inspection, and sometimes come as a surprise to first-time home buyers who had only heard about the down payment - especially because they can't be rolled into the loan itself. In other words, expect to have to pay several thousand dollars out-of-pocket when you go to buy a home.

It can be difficult to save money while you’re paying rent, but you always have options. Start tracking your weekly expenses using an app like Mint so you know exactly where your money is going. Indulgences like takeout and bar visits are often the easiest things to temporarily replace because it’s possible to eat food and spend time with people without actually spending much money.

According to Next Gen Personal Finance, the average credit score of U.S. renters is 638. By contrast, the average credit score of homebuyers is 731. That’s almost a 100-point difference and speaks to the importance of getting your credit score up before applying for a home loan. The minimum score you need for a conventional mortgage is 620 (though with some programs you can go lower). And that 100 points will likely equate to hundreds of dollars per month, and tens of thousands of dollars over the lifetime of your loan.

"Before you even start saving, do a free credit report, and find out where you stand. There are a lot of people who start this process who think 'I get credit card offers in the mail all the time, so I’m fine', but that’s not a sign of anything," notes Bauer.

Spending a few hours researching what impacts your credit score can make a world of difference when you’re making financial decisions. It’s not always a good thing, for example, to cancel a credit card, and existing debt can be good for your credit score so long as you regularly pay it off on time and in full. If you’re struggling with your score, meet with a credit counselor - they can help you work towards a better score.

"I've had far too many experiences where people have money and think they're ready to go, and credit is the last thing they consider. And despite all their savings, they can't get a loan - or they can get a loan with a very high interest rate - and it changes their whole outlook. You might have money and you might be ready to rock, but if the bank isn't going to lend you any money, it makes no difference," he adds.

As a renter, you'll need to understand your home buying timeline so that you know when to end your lease - or when to ask for a month-to-month extension. You might be surprised to learn that it takes 90 days on average to buy a home (starting with finding a Realtor) but it can take much longer in a competitive market, and when you’re a first-time homebuyer.

"Renters should plan on needing, at a minimum, three months. Sometimes there’s a misunderstanding by first-time homebuyers about what the process is, and they don't realize it takes a while to find your house, especially in this market," says Bauer.

He further explains that part of the process is realizing that not every listing lives up to expectations - but the only way to figure this out is to see the home in person.

"It’s going to be a process to find the home you’re looking for," he explains. "A lot of places look great in listings and you're thinking 'yep this is the one,' but in person, it isn't even close - it checks none of the boxes. Then we find 'the one'... and it’s the one that six other people like."

Once you actually find a home you like and your offer is accepted, there's an additional waiting period required to close/for the former owners to move out, which won't be instantaneous.

"You’re typically looking at at least 30 days to close. Sometimes in a perfect situation, it’s less than that, but the bank needs time to process the loan and the title team needs time to clear the title. And sometimes you need to give a 30-day or 60-day rentback once you win your bidding," he notes.

So make sure in the meantime you understand your rental agreement, and know how flexible your landlord can be about move-out times.

There’s often a learning curve that comes with buying and owning a home - and your friends that have gone through it can often be a good resource. Ask them what they would’ve done differently, what surprised them, and what advice they would give to potential home buyers.

Your friend might also advise you that it’s important to only take on repairs and renovations that you’re absolutely certain you’re capable of doing. According to a study by Real Estate Witch, for example, millennials are much more likely to purchase a home that requires extensive repairs - yet 25% who do so end up regretting it.

So if you’re one of those people who buy all the tools for a new hobby and then end up leaving everything unopened or half done, you may want to think twice about pulling up a carpet and replacing outdated bathroom tiles by yourself.

The best way to avoid common home buying mistakes is often to learn from those who have already made them!

It’s easy as a renter to dream big when it comes to your future house, but in all likelihood, you’ll need to make some compromises when it comes to buying your first house. You might want a house close to work that also has outdoor space for your dog, but realistically you might only be able to get one of those things.

Work on getting a list of your priorities ready so that you can approach your first meeting with a Realtor with realistic expectations.

A lot of renters assume it will be difficult to get a home loan if they already have student debt in addition to their rent, car payments, etc. However, it’s very normal and acceptable for home loan applicants to have student debt. What a loan officer will care about is whether you’ve been making your payments on time (and thus have a good credit score), and your debt-to-income ratio (if more than 43% of your income goes toward debt, the lender will not approve your loan).

If you’re thinking about paying off your debt before buying a home, again, it’s a good idea to meet with a mortgage advisor first. Sometimes it can make more financial sense to keep paying down your debt while saving for your closing costs instead - and then after you’ve successfully moved into your new home, you can think about saving up your money and paying off old debt.

Resource: What Not to Do During the Mortgage Process (Avoid These 10 Mistakes)

If you’re one of the 64% of Americans living paycheck to paycheck, you’re going to need to re-orient your approach to savings if you want to own a home. Living paycheck to paycheck is extremely unwise once you have mortgage payments because lenders are fairly inflexible - and this can be a difficult adjustment for renters who have gotten used to a more lenient system with landlords.

You’ll need to have enough money saved so that if something goes wrong - you lose your job, or need to pay a $1,000 car deductible, or have unexpected medical bills - you won’t risk defaulting on your home loan that month.

What happens if you are late on a mortgage payment? Once your grace period ends (usually 15 days), the lender will report your missed payment to the credit bureaus - meaning your credit score will take an immediate hit. And once you’re 90 days late, the bank will issue you a Notice of Default. From there, you’ll typically have 90 days to repay the debt before the lender forecloses on your home.

A foreclosure not only means you lose whatever money you initially put into the home - but you’ll also take a massive hit to your credit score (typically 100 points or more). So it's incredibly important to make your payments on time.

Rent-to-own deals are rare these days, but not unheard of - and they come up often in discussions about how to save for a house while renting.

When you rent to own you typically pay a one-time fee to have an “option” for the home’s sale. This gives you the "option” to buy the home at some point in the future. You and your landlord will typically agree on a future price of the home - usually more than it’s worth now, to account for appreciation.

Your agreement will then specify what percentage of your rent goes toward the purchase price of the home - and it likely won’t be 100%. In fact, 25% is more likely. The landlord might make you responsible for some of the home’s maintenance, which isn’t part of a normal rental agreement. If you decide not to buy the home at the end of the lease term, you’ll usually lose all the money you put into it.

Financially speaking, you’re usually better off buying a home yourself on the open market and putting 100% of your money toward your own mortgage payment and equity. However, rent-to-own setups can sometimes make sense for people who would struggle to qualify for a “traditional” loan despite being financially responsible.

If you've been wondering how to buy a house while renting an apartment, you're not alone. As rent prices continue to skyrocket and renters often find themselves having little control over their monthly payments, it's a question on the minds of plenty.

Here's what you need to do, in summary:

Buying a home isn't always easy, but it is possible - and with a bit of planning, you can exit the rental cycle for good.

Subscribe to our newsletter to get essential real estate insights.

Posted on May 16, 2022

Is it hard for a single person to buy a house? This question is often at the forefront of people’s...

Posted on May 16, 2022

According to a recent Bankrate survey, about 20% of millennials are unhappy with their home...

Posted on May 16, 2022

How do people afford houses? It might seem like an impossible task, depending on where you are in...