Should You Sell With Offerpad? Read This First.

Posted on Dec 20, 2022

What is Offerpad? Offerpad is an iBuyer company that buys homes directly from homeowners, saving...

Posted on Dec 20, 2022

Is it time to swoop in and gobble up properties after they drop in value? The question of whether or not the housing market is going to crash in 2023 is a valid one. The housing market has been behaving erratically - prices rose at breakneck speed, only to hit the brakes once mortgage rates rose.

The short answer is that, without a cataclysmic event taking place, the U.S. is highly unlikely to experience a housing crash.

At best, the market is likely to experience a price correction.

Here’s why.

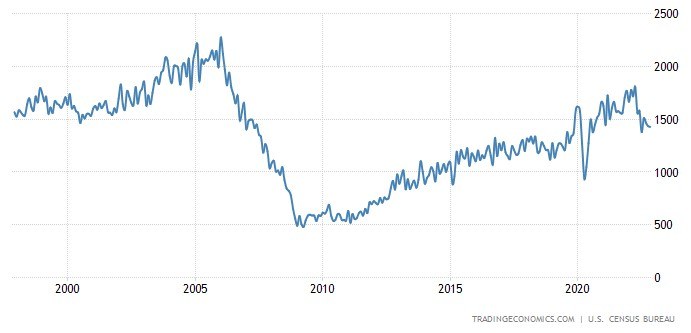

Many people who experienced the 2008 housing crash thought the lesson was, “high prices = housing crash.” However, reality was more complicated.

In the early 2000s, lenders had relaxed their lending standards to the point that high-risk buyers could qualify for homes. These buyers with bad credit often had next to no equity in their homes and received what are known as sub-prime mortgages. With so many unqualified buyers snapping up homes, a housing bubble formed.

When home prices dipped slightly, the entire system began to fold like a house of cards. The buyers with little equity in their homes found that they owed more on the loans than their homes were worth on the open market, so they couldn't just sell them. Foreclosures skyrocketed, causing home prices to fall even further. Several mortgage institutions collapsed.

After that, the government stepped in with reforms and regulations to try and ensure this wouldn't happen again.

It’s (very) fair to say that the 2008 crisis is more complicated than this, but the important thing to know is that the conditions leading up to the housing crash were unique - and are not being replicated today.

Rising prices were a symptom of underlying issues, but rising prices were not the cause of the housing crash.

Today, mortgage lenders have strict regulations about who can borrow money for a mortgage - so buyers are more qualified than ever and have a lot of equity in their homes.

"Some of the factors that led to the Lehman Brothers collapse are present in the market, especially how fast home values rose in such a short period of time. But overall, the economic situation is more sturdy now and lending practices are much stricter. It would take more than what caused the 2008 crash for another one to occur," explains Muoki Musau, a Virginia-based Houwzer buyer agent.

And what about foreclosures? Foreclosure starts have only recently increased back to pre-pandemic levels (during which they were artificially low due to moratoriums put in place by the U.S. government). Homeowners now have a record amount of equity in their homes so that even if they get behind on their payments or prices dip, they can usually sell the home for a profit and pay off their loan - no foreclosure necessary.

"Foreclosures and forbearances in a delinquent status of more than 60-120 days are very low now," notes Musau. "I believe there will be more distressed properties in the near future, even next year, but not to the extent that some people might call a 'foreclosure wave.'"

It may feel like there are rumblings indicating a housing crash could happen at any minute. However, these rumors have persisted almost since the last housing crash - but home prices never fell by any significant amount.

The price of housing may have seemed impossibly high to people in 2018, for example, but in retrospect, the median home price was $293,000 then - compared to $398,500 now.

As high as prices may seem, they may still be the lowest you ever experience going forward.

Another reason we're unlikely to experience a crash: housing inventory is low. Around 5-6 months supply of homes is considered a balanced market; currently we're at 3.3 months (a seller's market). In 2007 before the crash, the U.S. had 8.4 months' inventory.

The U.S. is currently suffering from a lack of housing inventory for several key reasons.

Ultimately, as long as inventory remains low - and population growth/household formations outpace new home builds - competition for existing homes will keep prices high. Because housing is a fundamental need, consumers are often willing to pay a higher amount than what is comfortable if it means owning a house.

And if consumer interest in housing was to wane, the reality is that investors would be on the sidelines ready to swoop in. When a housing crash happens it’s investors who benefit the most - not the average American.

Even if there isn’t a housing crash, it’s possible home prices could decline in the near future. On average, property prices appreciate at a rate of 4% per year.

Many housing experts are predicting that 2023 will see a rate of around 0% appreciation, which will give average income a chance to catch up.

Home prices have risen so dramatically that a price reduction in many locales will simply be a reset to prices in 2020. This may not be the dramatic drop that potential home buyers are hoping for, but it’s the likely scenario that they should be prepared for.

"When prices and rates go lower, more people think to themselves, 'I can finally afford something!' and more people look at the same homes. Until markets balance between supply and demand, buyers will most likely choose between low competition or low prices. Just like the competition peaked with low rates, a similar effect will occur when prices drop, especially because inventory is still lagging behind household formation," says Musau.

So: will the housing market crash in 2023? Most industry experts seem to think otherwise, based on the available data.

To review, a 2023 housing market crash is unlikely because:

Of course, unpredictable catastrophic events - like war - could happen and upend everything.

But here's the thing: waiting for the housing market to crash is a passive plan that puts market forces in control of your future - not you.

Making a proactive plan to become a homeowner, by contrast, gives you agency - so that you can stop paying your landlord’s mortgage, and start building equity.

Today’s situation may not be perfect, but if you have enough money to cover 75% of your future dream house, then begin your home owning journey with a starter home that’s 75% the cost. This may mean opting to live in a smaller home, a home with outdated furnishings, or a home that is further away from restaurants and cafes. But it can be your home - and that’s the key.

"Most people who're waiting for a crash are really waiting for housing to become more affordable. But just because housing becomes affordable doesn't mean people are prepared to buy, so my advice is to start organizing your priorities in what you want in a home and other big-picture items," advises Musau. "Rates have been dropping, and inflation will hopefully come more under control, so it's just a matter of finding the home, strategy, and timing that work for each buyer's unique situation."

Your first step toward homeownership should be meeting with an experienced local Realtor. When you buy a home, it’s the seller who pays the commission fees - so you can reap the benefits of an agent’s knowledge without having to pay anything extra. They can help you figure out what type of home you can qualify for, and what type of home you’d be comfortable buying based on the projected monthly payments.

(it's free and comes with no obligation)

Will you get your dream home as the result of a housing crash? Probably not. But for many people, it is possible to become a homeowner if you research your options and start with what you can afford.

Subscribe to our newsletter to get essential real estate insights.

Posted on Dec 20, 2022

What is Offerpad? Offerpad is an iBuyer company that buys homes directly from homeowners, saving...

Posted on Dec 20, 2022

According to data released by Zillow, U.S. home prices rose 13.2% over the past year. Fewer homes...

Posted on Dec 20, 2022

The spring real estate market was supposed to be hot. Months of extremely low inventory, combined...