The COVID-19 global pandemic has created enormous uncertainty throughout the world. The health concern is growing, the global markets remain volatile, and millions of people are facing unemployment. This is uncharted territory. And as you can imagine, we have received a lot of questions from clients, employees, and investors about the implications for both our business and the economy. There has also been a healthy discussion around how a looming recession will impact the housing market.

First and foremost, Houwzer remains on sound financial footing coming off our Series A financing round in February. With a strong balance sheet, we still intend to grow year over year through this market condition. Second, we believe that any market outlook should be rooted in, and informed by, sound data. While recognizing these are unprecedented times, below you will find our market outlook and predictions for what the future holds for the housing market in our current regions and beyond.

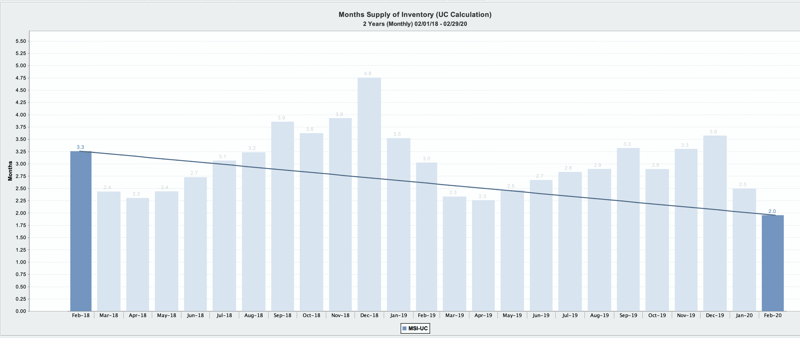

Through the end of February 2020, all Houwzer markets were in extreme seller’s market conditions with around 2.0 months of inventory in PA/NJ and 0.9 months of inventory in DC/MD/VA. Both of these measures were all-time record lows. Though we do not yet have complete data for March 2020, preliminary data suggests that these figures hit new all-time lows again in March:

Feb ‘18 to Feb ‘20 decline in inventory in the PHL market. DC and BAL markets have a similar seasonal shape and long-term trend.

Because of this, there is no reason to believe that when the world emerges from the COVID-19 crisis that market conditions will be any different. In our own lead funnel, we have seen seller interest drop off significantly while buyer interest has remained steady. In addition, there is a national surge of refinancing at record low rates which implies that there is more desire to tap equity via refinancing rather than via the sale of the home at this time. A major driver for this trend is the yield on the 10-year Treasury notes (the main leading indicator of future mortgage rates), which are at a sustained all-time low.

The Fed Funds rate is at zero and the only interest rate lever remaining at the Fed is to go negative as some other countries have done. The Fed’s recent dramatic cut to zero was intended to increase asset prices in a falling stock market, however it will also have the effect of supercharging still-hot home prices when commerce resumes as normal. Most of the quantitative data that we have suggests that the seller’s market will continue to become more and more extreme.

Fundamentally, there are some strong anecdotal reasons to believe that there is a latent “shadow inventory” of listings that have not hit the market out of caution during the crisis that may hit all at once as conditions return to normal. Additionally, we believe there will be forced sellers due to the massive spike in unemployment and vacant Airbnb inventory. Even before the pandemic we also were observing a slight uptick in foreclosure activity in some areas that may now grow steadily. All of these early signs point to a possible momentum shift and potential trend toward inventory growth. Even if this momentum shift occurs it will take a considerable amount of time to change the character of the housing market given the significant pent-up buyer demand that continues to exist.

Even supposing there is a full-blown economic depression, it is likely still not enough to move the needle closer to a buyer’s market quickly. In our markets, we would need to add 6-9 months of inventory (400-1000% growth from February’s numbers and possibly even more from March’s) to suddenly come on the market in order to shift to even a mild buyer’s market. There is no historical precedent for that kind of change in listing inventory in any short period of time. Even in the subprime crisis of the late ‘00s (which unlike this crisis affected housing more than any other segment since housing was the cause of the crisis) the full transition from peak seller’s to peak buyer’s market took 3 to 4 years to play out (during which there was a 1-2 year balanced market) before shifting back toward the seller’s market we are in today (which took the better part of a decade.)

We are currently at unprecedented levels of low inventory, which is considered an extreme seller’s market. A balanced market is considered to be 6-8 months of supply (= 13-17% absorption.) A buyer’s market is considered to be >8 months supply (< 13% absorption) and a seller’s market is considered to be <6 months supply (> 17% absorption.)

Given how volatile and uncertain the current situation is today, it is hard to be overly confident in this outlook, and we should be prepared for essentially anything to happen in the short term. However, all of the data and historical precedent that we do have points to either a continuation of pre-crisis seller’s market conditions or the beginning of a trend toward a buyer’s market unfolding over the coming quarters and years.

Time will tell how everything unfolds. The one thing you can count on is that Houwzer was built to change the real estate industry for good. In times like these, we have the opportunity to really help homeowners save when they sell and trust when they buy. And our W2 real estate agents have the comfort of a salary unlike so many other 1099 independent contractor agents. Enduring companies find a way to not just survive, but to thrive, in the face of adversity. We promise to keep you up to date with more data-driven content in the coming weeks and months.

- Mike Maher, Houwzer CEO