Orlando Airbnb

Posted on Apr 24, 2023

Thanks to its world-renowned theme parks, numerous conference facilities, and great weather,...

Posted on Apr 24, 2023

Airbnb has risen in popularity not only for vacationers, but for homebuyers as well. Not only can they make money in the short term from rentals - they can also pay off the home’s mortgage in the process, thereby increasing their personal equity.

Airbnb (and other sites like it, including VRBO) are seen as a way to generate additional income around a schedule that works for you.

If you’ve never bought an Airbnb property before, though, there’s a lot you need to plan and account for. Here’s how to buy an Airbnb and maintain profitability.

When you see that the average price for a single night stay in Philadelphia is $157, it’s easy to see dollar signs and imagine how quickly you could generate profit on that home. What you need to do before you team up with a Realtor, though, is determine how much it would actually cost you to rent out a home versus how much you make on it. Here are some of the costs you’ll need to account for.

Newbies to the short-term rental industry often look at the rates a host can charge per night, and quickly imagine receiving that rate for 30 days every month. However, you need to plan on occupancy rates almost never reaching 100%.

Not only that, but you’ll need to be flexible: occupancy rates can vary depending on everything from location, to the time of year. According to AllTheRooms, Hawaii has the highest Airbnb occupancy rate of any state - not surprising considering it’s the ultimate vacation destination. But even then, the average occupancy rate is 65% - meaning that for the average year, the property is unoccupied for about four months total.

You can increase your occupancy rate by lowering your price, but lowering your price can sometimes attract the type of guests who are always looking for a discount (and may look for reasons to ask for money back once they've rented). The national average occupancy rate is 48% - so only move forward with buying a property if you can still profit on your home being occupied for just half of the month.

Even if vacationers exit, you’ll still be on the hook for your mortgage. Will you make enough from your Airbnb to put aside savings every month? When COVID-19 happened, many Airbnb hosts lost thousands of dollars when the company allowed guests to pull out of their reservations without penalty, and afterward when no one was traveling.

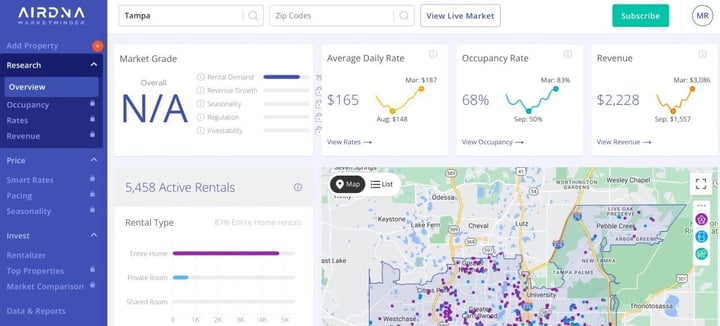

A good resource to bookmark:sites like AirDNA crunch the numbers of local occupancy rate for Airbnb and other short-term rental sites. When you're looking for a property, this can help you plan accurately. Once you own a property, sites like this allow you to scope out how the competition is doing - and stay competitive using tools like smart pricing.

You might assume that the best place to plunk down an Airbnb property is in the middle of a popular tourist destination. While there are definitely advantages to this - you can often charge a premium for these spaces - the problem is that your Airbnb is an investment you need to pay off, and your mortgage will likely be much higher in the middle of a major city.

Some of the best locations for an Airbnb are actually out-of-the-way areas where travelers frequent, but competition for homes is low.

According to IGMS, a vacation rental software company, the best current Airbnb markets in the US include Charleston, South Carolina, The Poconos, Pennsylvania, Slidell, Louisiana and Chatanooga, Tennessee.

Conversely, according to Creu University, Miami Beach, Florida, Houston, Texas, and Venice, California are some of the worst markets to invest in. While demand for Airbnb might be high in these areas, there’s also a ton of competition from other Airbnb owners - and the cost of purchasing property is high enough to make profitability harder to achieve.

Your needs as an Airbnb investor are different than a couple looking for a place to raise your family - so make sure you work with a Realtor who understands your unique needs and can scout properties accordingly. A smaller kitchen, for example, isn’t going to be as much of a problem for guests who likely aren’t going to spend too much time cooking - whereas an additional half-bath will help your listing stand out.

What’s the advantage of working with Houwzer to buy Airbnb property? When you bundle our mortgage and title services with your home purchase, you receive $2,500 back at the closing table. That’s money you can use instantly on luxurious touches and fresh furniture that help boost your potential earnings.

Airbnb has grown dramatically as a company over the years. On the one hand, the company sees more revenue coming in from rentals than ever before - the third quarter of 2022 was Airbnb’s most profitable ever, with net income reaching $1.2 billion - up an incredible 42% from the same time the previous year.

At the same time, though, millions of people have now been exposed to the idea that Airbnb is an extremely lucrative way to generate additional income while getting to set your own schedule and ultimately reaping the benefits of holding onto property. About 14,000 new hosts joined the platform each month of 2022, and in the same year many hosts reported a drop in bookings and in many areas, an over-saturation of homes on the platform.

Potential hosts should keep this top of mind as they move forward, because listings are ultimately a competition. The hosts who can keep costs lower in a saturated market are often going to be able to book the most stays. And the last thing you want for a property you’re paying a mortgage on, is for it to sit empty for months at a time while you wait for someone to click.

Although Airbnb owners might dislike the idea of government oversight of short-term rentals on principle, in actuality it could help your bottom line to be in an area with limitations. So long as you’re able to get a license to operate, your competition will always be limited. Over-saturation - and the associated low-occupancy rates - is more likely to happen in regions with no regulations.

Although cross-posting to multiple hosting platforms (like VRBO) is an option, it doesn’t entirely eliminate the risk -since most competitors will be aware of this too.

Even if Airbnb is the goal, homeowners should be willing and financially able to convert their properties into longterm rentals, or sell them if necessary, to deal with market saturation.

Unless you rely on a property management company to run your Airbnb for you (see below), you shouldn't think owning an Airbnb will be “passive” income - which means you need to participate in order for the money to flow in.

You'll be part of the hospitality industry, and you’ll be expected by guests (and by Airbnb) to adhere to certain standards that are often above and beyond what a typical rental property would require.

If the heat goes out in your unit - not only will an immediate fix be expected, but you’ll also likely be asked to refund part of the stay.

Even if you write clear instructions on how to open the lockbox, some renters may struggle anyway and expect your assistance - even if it’s 10pm at night and you’re on the other end of the city.

There are short term rental property managers that can take over the day-to-day responsibilities of running your Airbnb so you don't have to. Just keep in mind that this service can add 10% - 50% to your expenses, so it might be difficult to account for if you're just starting out.

There’s a few things you need to know about your mortgage when buying Airbnb property.

Just make sure that your lender knows that you're buying a house for Airbnb rather than for use as a primary residence. If you plan on renting out a home after living there for a year, your lender will not be as concerned.

Subscribe to our newsletter to get essential real estate insights.

Posted on Apr 24, 2023

Thanks to its world-renowned theme parks, numerous conference facilities, and great weather,...

Posted on Apr 24, 2023

Considering how hot the current housing market is, it’s no surprise that plenty of sellers are...

Posted on Apr 24, 2023

When the time comes for you to move on from your current home, you may wonder: should I sell or...