Each month, we are posting an updated Market Outlook based on the questions we continue to receive from clients, employees, and investors about the implications for the housing and mortgage markets in which we are active (read July’s Outlook here).

Last month’s guidance that the increasing pace of home sales was likely to persist into the summer has held true. Activity has ramped up in terms of both listings and contracts and there has yet to be any signs of the typical “summer lull” that we tend to see in August. The delayed spring market conditions at this point seem likely to bleed into the fall as buyers and sellers make up for missed time earlier this year.

Though the current rise of COVID-19 cases in many parts of the country has continued, and despite worrying signs pointing to a longer recovery from the pandemic than many were forecasting, we still do not expect another near-complete shutdown of activity like we saw in previous months. It seems that although the conditions for conducting business are still challenging, the real estate market is surging forward unabated.

Housing

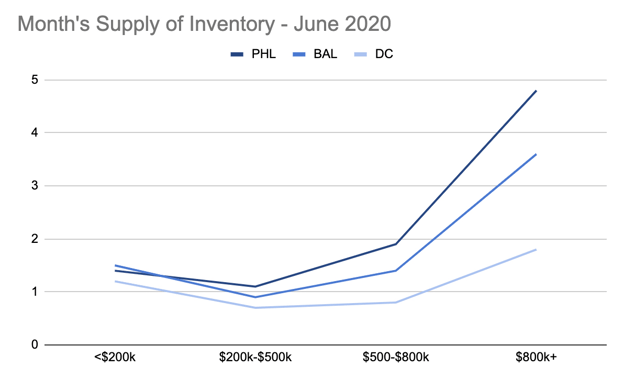

The most recent data shows yet another consecutive month where inventory is pushing new lows in all of our markets. In order to dig into this in more detail, we segmented our month’s supply calculations for June into the four price bands below, by market:

As you can see, homes that are affordable for those in middle and upper middle income brackets are in extremely short supply across the Mid-Atlantic. Homes priced from $200k-$800k are moving very quickly, and the only bit of inventory anywhere in the market is at the highest price points, where conditions are more balanced.

Mortgage

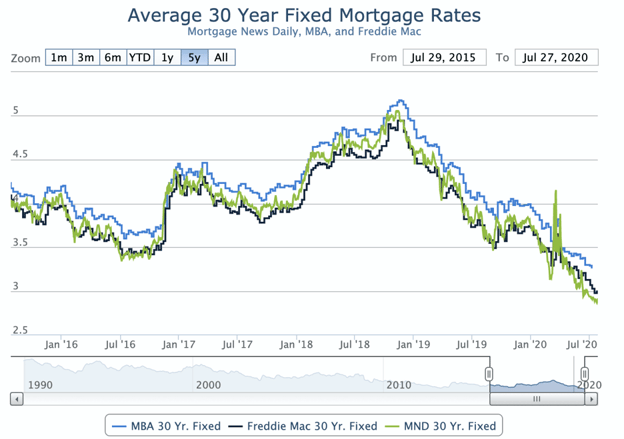

June was believed to be the "best month ever” for mortgage rates, but we had an even better month this July with rates continuing to rewrite the record books for all time lows:

These low rates are a big driver of the low inventory we’re seeing in the market. There is a feeding frenzy driven by the low rate environment and strong demand for homes. It is still a great time to consider refinancing your current mortgage rates with our trusted advisors in order to save thousands over the lifetime of your loan.

At some point these outlandish figures will hit a bottom and reverse course, but not even a worldwide pandemic has been able to disrupt what has been a many years-long seller’s market.

As the pandemic continues and a new stimulus bill winds its way through Congress, and with the same macro market trends stubbornly persisting, it feels like little has changed since the spring. Given all that has happened, it’s hard to imagine what might finally dislodge the current trajectory. But, in 2020, who knows what will happen next.

- Mike Maher, Houwzer CEO